The stock market isn’t like any old day job. Although many people consider it to be as such, with strict times on when you can trade and when you can’t, there are loopholes and times where you can try to beat the market. An example of this is pre market trading, which takes place before regular market times. But just what is the difference between pre market trading and regular trading, and how can you benefit from it? What do you need to keep in mind? How should you prepare for it? We’re here to give you the answers to all of these questions, so here is our guide on you can reap the rewards of pre market trading.

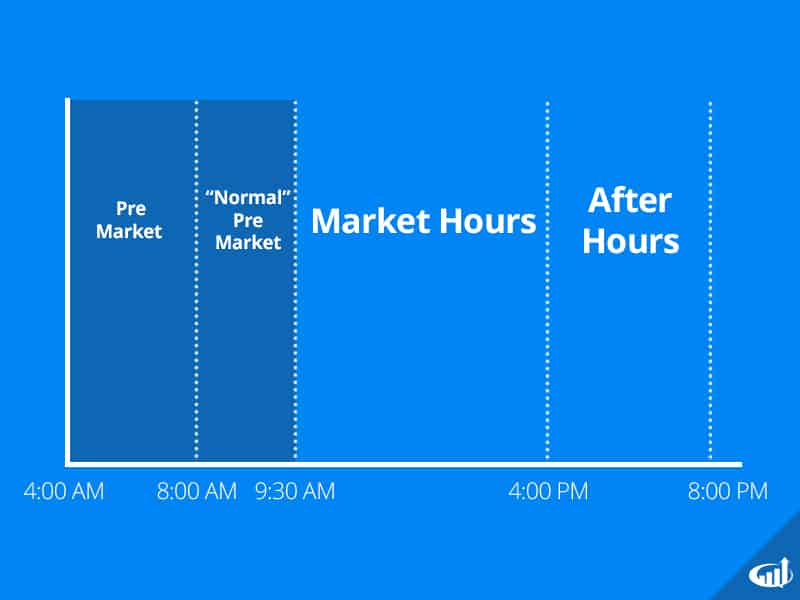

Pre-market trading refers to activity in the stock market happening before the regular market session opens. The stocks that are moving after the market for the day and before it opens the next morning are sometimes nicknamed called pre-market movers. Usually, the movements are focused in the early morning, in the hours preceding the regular stock market opening at 9:30 a.m., Monday through Friday. Usually, pre-market trading sessions will be open somewhere between 4–9:30 a.m. For example: The NASDAQ premarket session occurs from 4:15–9:29 a.m. Eastern time. This brings it right up to the moment when the regular session opens.

Almost anyone can participate in pre-market trading, but that doesn’t mean it’s easy, or you can just jump straight into it. Several brokers count pre-market trading among their offerings, but some limit what types of orders can be used. So look no further than Zack’s Investment if you’re looking for a website to help you with your stock market research. The company’s research is backed by quantitative methods. Zack’s review provides stock recommendations based on fundamental analysis and earnings estimates. The exact timeframe during which pre-market trading can happen can also depend on the broker. For example: one broker might offer a pre-market session from 4–9:30 a.m., whereas another might offer a pre-market trading session running from 6–9:30 a.m. The style and how pre-market trades are executed can also vary depending on the broker. Some brokers, especially the big ones, typically tend to just stick to their regular commissions for these pre-market trades.

Learning how to analyse pre market trading is incredibly difficult, but luckily Timothy Sykes’ article on pre market trading discusses how to do it. Some of the ways to do so are as follows:

- Keep up with the headlines. Be sure to look for news that could affect open positions. Upgrades, downgrades, and other stories that can move stocks can help you discover and uncover opportunities for the upcoming session as well as in the pre-market.

- Look at index futures. Be sure to look at the overnight session highs and lows as reported on the Russell 2000 Index futures, S&P 500, and NASDAQ 100. This is important because it creates support and resistance during the regular market hours.

- Consider macro forces. Consider what is moving macros, economically speaking. News items are the big catalyst here. See what has been moving the world markets and think about how it could have an impact on the U.S. session. For example: News regarding a central bank or a big item of economic data could make for market movement.

- Keep track of other traders. What are other traders doing in the pre-market? You can do a scan of pre-market securities by volume on a platform like StocksToTrade and get an idea of where other traders are putting their money. You can then cross reference this information by looking for catalysts or other things that could be causing the activity.

- Get on the level. Levels matter when analyzing pre-market trading. Check out the key levels on open positions. Watch for index futures, particularly after big economic data releases. This can precede breakouts or breakdowns in the normal trading hours.

- Think about timing. Timing is everything when making trades. Take into consideration the time of year, the month, and even the day in question. The season, the proximity to a holiday, the release of earnings reports, and so many things can play into a stock’s performance.

- Consider the algos. While algorithmic trading is a topic for another day, it’s about algorithms pushing securities to move, and can blow up or deflate the prices temporarily. Could you use these dips to potentially create opportunities?

- Don’t be swayed. Even if you see a stock going extremely red or green the pre-market, it may not matter. You still need to do research on the expectations for the stock.

- Be the early bird. Beat the crowd. Use your pre-market research to prepare a list of potential trades. Formulate a great trading plan so that you can execute quickly if you see your entry.

You should also learn the difference between pre market and after market trading hours. Basically, the difference is just what it sounds like. The pre-market trading session occurs in the morning hours before the markets open. After-hours trading occurs during the hours after the markets close, usually 4–8 p.m. Check with your broker to see the exact hours available to you. Like some pre-market broker restrictions, after-hours trading may be subject to some limits and potentially a different fee schedule. Bottom line: Do what the SEC suggests and read all disclosure documents before proceeding. Is one is safer than the other? Not necessarily. Both pre-and post-market trading can be illiquid, making for potentially wide spreads and volatility.

To benefit from pre market trading, you should also wait for any news before you purchase any stocks. If you fail to do this, you will probably fail to reap any real benefits. For many, there’s not much of a benefit to trading in the pre-market hours. This is part of the reason why the pre-market often begins only at 8 a.m. This is when the volume often gains momentum and we can begin to see more direct results of the news. Even in such situations, it might still be wise to wait until the market opens or slightly after. However, pre-market trading exists for a reason, and while it’s not always reliable, it’s sometimes possible to gain profits during this time.